Accountable Care - Transforming Healthcare Delivery

At no other time in the history of our country has the healthcare delivery system so rapidly transformed as it has since the passage of the Affordable Care Act (ACA). With healthcare consuming nearly 20% of our country's GDP, traditional fee for service medicine simply was not sustainable. Accountable Care Organizations ("ACO's") hope to change that with the aim of improving population health, improving the care experience and reducing the per-capita cost. The Centers for Medicare and Medicaid Services (CMS) have very clear rules and definitions as to what might comprise an ACO for the Medicare market, but when it comes to what it means for the private sector, definitions vary. An ACO is a health care delivery system that has partnered with a payer or purchaser of health care to develop arrangements that align financial interests with the delivery of effective and quality care for a specific population. However, if you have seen one ACO ... you have seen one ACO since success is contingent upon IT integration, physician-led affiliation, care coordination, access, prevention and convenience, and payment reform that aligns stakeholder interests.

Many plan sponsors might first think an ACO of today is simply warmed over "HMO soup", reheated from the 1990's. What's different is that we have advances in technology, larger systems of care with greater physician/hospital collaboration, bigger federal incentives and a decade of best practices to guide us. Many systems will be smart to avoid the mistakes made during the HMO era when the market greatly underpriced premiums, withheld care and failed to model risk accurately. We're only in the first inning of the ACO era that will continue to lead to pay for performance, bundled payments, episodic risk sharing and more fully capitated transfer of risk for health sytems.

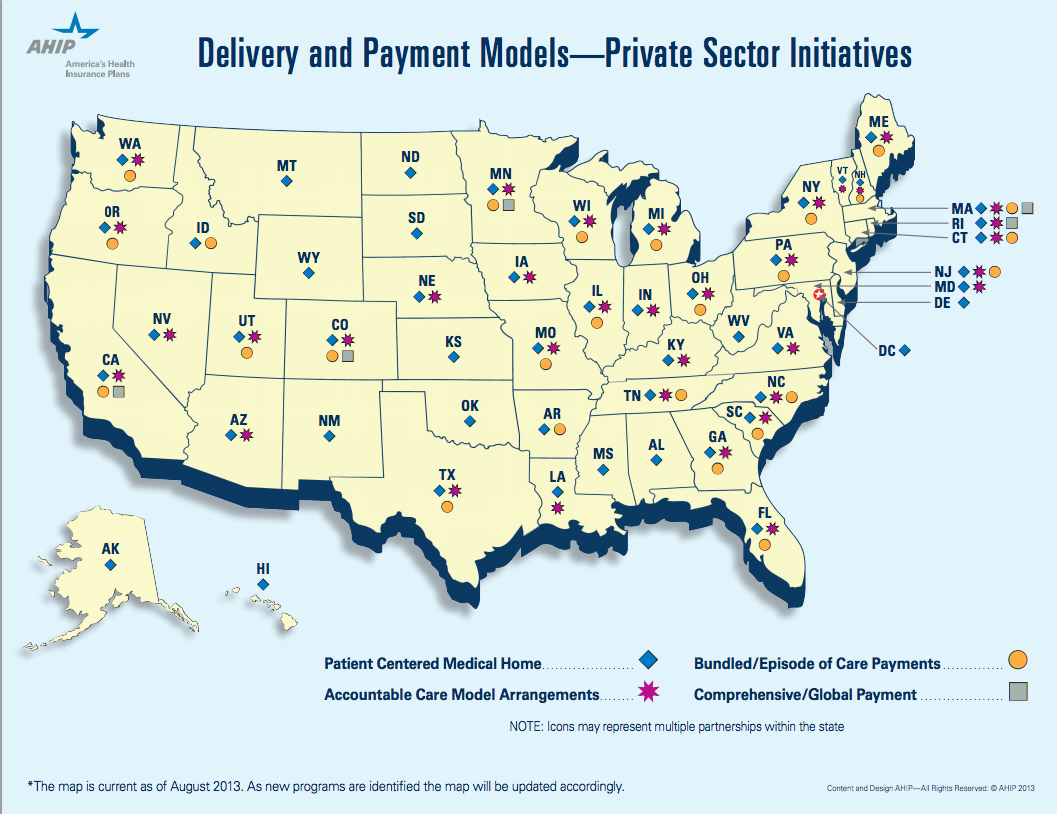

According to Leavitt Partners latest study, there are over 600 ACOs now across the United States:

There are three considerations that should prompt employers of all sizes to consider ACO's in their employee benefits portfolio:

1) Available Now - Traditional health insurers, physician groups and health systems have been hard at work building partnerships that incorporate shared risk arrangements. Last year, ACOs began rolling their products out to our benefit consulting teams for us to share with our clients. We were pleased to learn the health systems and carriers are "eating at their own restaurant" by enrolling their employees into their own ACO over the last couple of years. For the early adopter seeking alternatives that promise greater value with a narrower network or steerage mechanisms, ACO options are available now throughout the country. Our firm has examples of clients who have deployed narrow network strategies in partnership with hospital based systems anchored in DFW. One of the largests now boasts a network of approximately 50 hospitals, 500 patient access points and 6,000 affiliated physicians.

2) Geographic Density - Since ACOs are about the delivery of healthcare at the local level, employers with great density (concentrations of a large number of employees) will fare better with this strategy. In California for instance, CALPERS, one of the state's largest plan sponsors, had enough clout to form a direct contract with a upside premium credit of nearly $16MM with a physicians group, Blues plan and hospital system. This alliance was formed to compete against the dominate player in the area, Kaiser of California. If you are the major employer in an area, you and other employers have more clout than you might think in this new era of ACO alignment.

3) Show Me the Money - The most fundamental change that ACOs may bring to the market is a substantial increase in the levels of collaboration among payors and providers. So how will more integrated models prove to the private sector they can truly remove waste, impact steerage, align incentives with greater patient satisfaction? These integrated systems realize they must offer up savings in the form of guarantees, ,risk-adjusted PMPMs and total cost guarantees for us to consider their offering. Initial actuarial projections are targeting PMPM savings ranging from 5-10% off of current spending levels, as contracts mature.

But accountability is up to every organization and every body with a body. The ACO cannot foster health alone ... and that's why the early adopters must be prepared to lead with executive sponsorship, design and contribution alignment to drive steerage, coordination and communications that lend support to these exciting options. I am a voracious reader of Benefits Quarterly, a publication for peers in my industry. This excerpt, written by Isabelle Wang and Michael Maniccia of Deloitte, provides a good primer for employers to consider on the topic of ACOs and is available on their website or download here: