Americans have had a love affair with the automobiles ever since Henry Ford introduced the Model-T in 1908 to the Model S of today. With all the hype around new model releases, A USA Today article found that Americans are actually holding onto our existing cars for longer periods of time. The average lifespan of a car on the road increased from 8 to 11 years over the last two decades. There were two primary reasons cited why we drive our vehicles longer: advancements in technology and changes in the economy are forcing us to become more thoughtful consumers. Michael Calkins, AAA's manager of technical services, cited that this trend brings "a corresponding rise in maintenance and repair costs as our vehicles age".

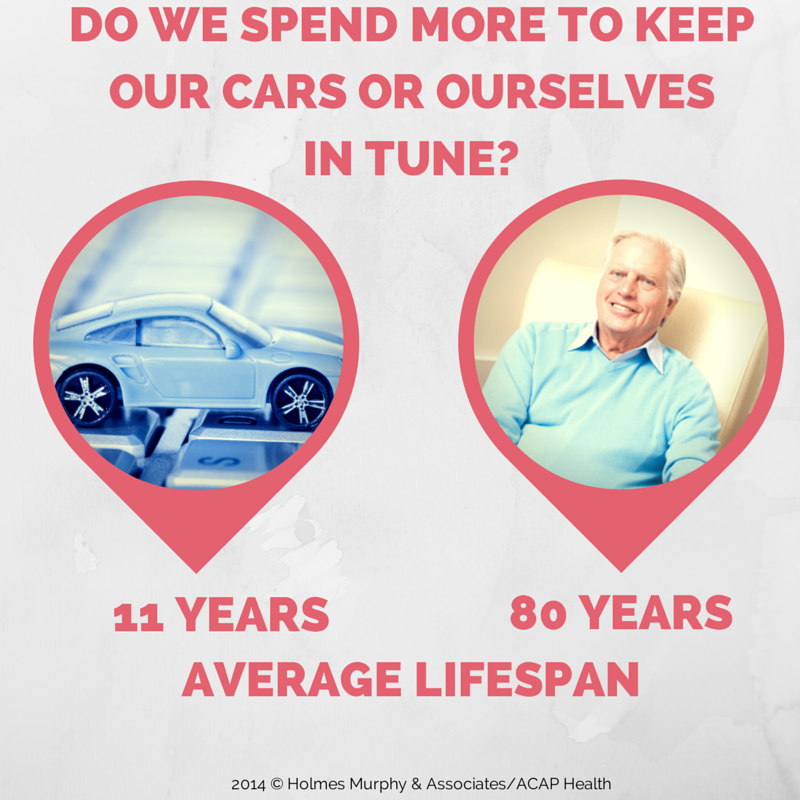

These same economic forces are occurring in healthcare as one out of every eight Americans will be 65 or older by 2030. The average American now has a life span approximating 80 years old. So how much exactly should we be investing in ourselves each year to keep humming down life's highway? We were curious to learn if we spend a greater percentage of money to keep our cars or ourselves in tune.

We decided to look at how much we spend each year to keep the asset in good working order and compare it to the annual ownership cost for each asset. Consumer Reports gave us the average amount Americans spend to maintain their cars each year divided by the annual cost of ownership. The annual ownership cost of our health is a function of the premium we pay to insure ourselves. We calculated the average wellness spend at $728 per year divided by the total health costs an active employee costs to insure in the workplace at $11,830 per year.

We decided to look at how much we spend each year to keep the asset in good working order and compare it to the annual ownership cost for each asset. Consumer Reports gave us the average amount Americans spend to maintain their cars each year divided by the annual cost of ownership. The annual ownership cost of our health is a function of the premium we pay to insure ourselves. We calculated the average wellness spend at $728 per year divided by the total health costs an active employee costs to insure in the workplace at $11,830 per year.

Surprisingly, our findings showed we spend the same percentage on both. Six cents of every dollar was spent to keep both of these assets in working order each year. Investing the same percentage in each might make sense if each asset depreciated at the same rate. The reality of this finding is that the less important asset we drive for eleven years and the more important asset (for most Americans) is driven into the ground for eighty.

At ACAP Health, our business models forecast plan sponsors will do better by investing closer to 10% of health spend towards prevention, as compared to the industry average of 6%. The right allocation will vary based on the demographics of your workforce, with additional screenings and diagnostic costs correlating with age. As technology enables more sophisticated modeling, we'll continue to see investments made in what I'm calling the "Preventive Economy". This approach to risk management will impact policy decisions on everything from climate change to obesity. And it will force health payors to reevaluate their current prevention vs. sickness allocation of health spend. Our company's big data analytics warehouse now incorporates 47 million lives and case studies using clinical algorithms tied to one's metabolic risk factors to help us better illustrate the trade-offs between a "pay a little now versus a lot later" approach to health plan sponsorship.

The Preventive Economy will also change the way these services are delivered. Think of the full-service gas and repair stations as the doctor's offices of today compared to the Jiffy Lube's in healthcare emerging for tomorrow. Accountable care, patient centered medical homes, retail pharmacy, telehealth and consumer directed models of preventive maintenance and diagnostic care are coming to the rescue to shore up the scarcity of primary care and nurse practitioners. The preventive economy foreshadows these services will be in strong demand to address the scarcity of supply needed for the coming age boom.

So as you evaluate next year's healthcare spend make sure you are investing more than low single digits towards preventive maintenance to avoid your engine light coming on ... because establishing a healthy lifestyle of keystone habits is the closest thing you'll find to an 80 year bumper to bumper warranty.