It's always fun to watch shoppers each holiday season camp out for hours to snap up bargains that pale in comparison to the savings available in the health care marketplace. If buyers put as much emphasis on shopping for health services throughout the year as we do on enrolling for coverage once a year, we could make greater strides to flatten the cost trajectory of care.

If there is one city that knows how to shop it's Big D, so here's a three-step process for any employer hoping to put a little "Black Friday" in their health plan:

It's always fun to watch shoppers each holiday season camp out for hours to snap up bargains that pale in comparison to the savings available in the health care marketplace. If buyers put as much emphasis on shopping for health services throughout the year as we do on enrolling for coverage once a year, we could make greater strides to flatten the cost trajectory of care.

If there is one city that knows how to shop it's Big D, so here's a three-step process for any employer hoping to put a little "Black Friday" in their health plan:

1. Offer A High-Deductible Plan:

A 'quiet revolution in health insurance' is taking place as the number of employees enrolled in a plan with an annual deductible of $1,000 or more has risen to nearly 40% in 2013. Among all plans, the average annual deductible among covered workers is over $1,100 and exceeds $1,700 for small firms (under 200 workers). (Kaiser/HRET Survey of Employer Sponsored Health Plans).

Milton Friedman wisely quipped "Nobody spends somebody else's money as wisely as he spends his own. Putting in a high deductible plan enables your employees to be economically rewarded for shopping around and strategically aligns your insurance plan to cover infrequent and high cost medical events.

2. Arbitrage your Network

In the 20th century days of health care consulting, we used to attend to great detail to reprice claims for employers wanting to select the right insurer and network health plan. This focus on network discount has given way to more sophisticated value equation models. Once your health plan/network is in place, the employer must then teach employees to exploit hidden value within the network throughout the year.

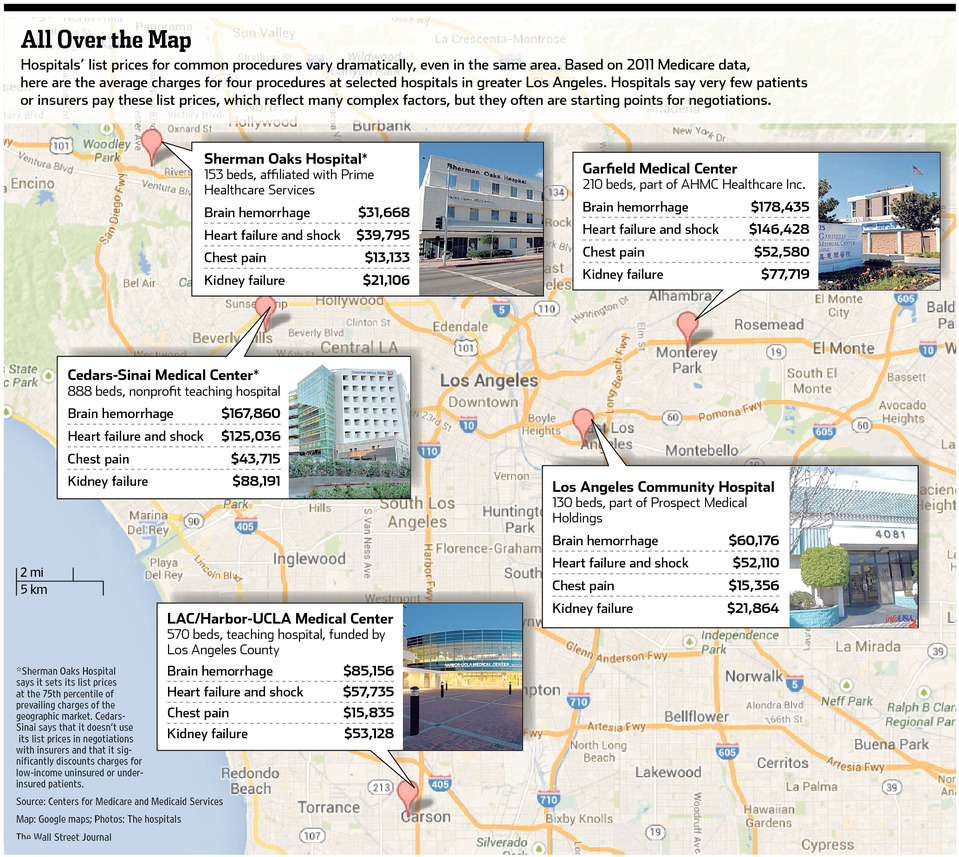

60% of medical and pharmacy claims come from non-emergent services. As an example, three facilities within a five-mile radius in Dallas offer the same in-network MRI for prices ranging from $600 to $3,000. Transparency laws are now enabling big data analytics software to quickly review over a billion national claim records for price and quality comparisons at the push of a button.

3. Shop with a trusted friend

The best health price transparency providers have realized that shopping for care is best delivered when technology is married with an independent consumer advocate. As an example, there are over thirty types of knee surgery, so having a personal concierge to help me navigate my options enables my family to build trust with an advisor that does not have a financial interest in the outcome. To revolutionize the system, we need to help our employees act on information, not just provide data.

Many DFW employers are well on their way to creating a shoppers mentality among their health plan enrollees. Consumer advocacy and pricing transparency programs have already returned annualized savings anywhere from four to twenty-four times the cost of the service.

In a town that continues to reinvent the shopping experience, we anticipate more companies to get on the "Black Friday" bandwagon when it comes to savings in their health plan. The best part is we can all be empowered to score health deals that would make a Walmart clerk gush just by picking up the phone.